QuickBooks Accounting and Taxation Essentials for Entrepreneurs & Business Owners

Master the Fundamentals, Navigate QuickBooks with Ease, Your Path to Accounting and Taxation Success Starts Here!

QuickBooks Accounting and Taxation Essentials

For Entrepreneurs & Business Owners

Master the Fundamentals, Navigate QuickBooks with Ease, Your Path to Accounting and Taxation Success Starts Here!

QuickBooks Accounting and Taxation Essentials for Entrepreneurs & Business Owners

About The Course

Embark on a journey to financial proficiency with our “QuickBooks and Accounting Essentials for Beginners” course. Designed for novices, delve into foundational accounting principles, exploring financial statements and understanding QuickBooks’ interface. Learn to record transactions efficiently, manage accounts receivable/payable, and generate insightful reports for informed decision-making. From mastering payroll to troubleshooting tips, gain practical skills to excel in business finance. Elevate your accounting prowess and unleash your entrepreneurial potential today

Course Instructor

Mian Raees Raza

EA (Enrolled Agent) license from Federal IRS since 2016, P&C (Property & Casualty) Insurance producer license from the state of NJ. CPB (Certified Public Bookkeeper), ACCA (Associate Certified Chartered Accountant) England, CAT (Certified Accounting Technician) England.

AT A GLANCE

1 Class in a Week

Duration : 2 Months

Video Recordings Available

Digital Certificate

Sessions

1. Introduction to Accounting

- Understanding the basics of accounting principles.

- Overview of financial statements: Balance Sheet, Income Statement, and Cash Flow.

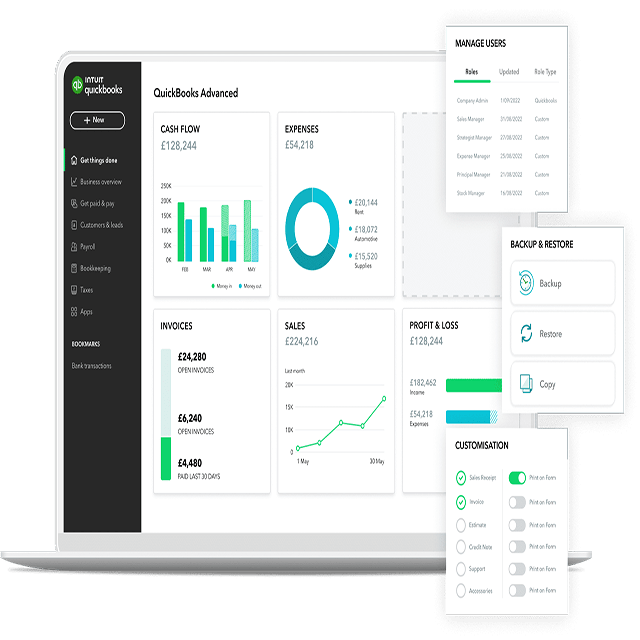

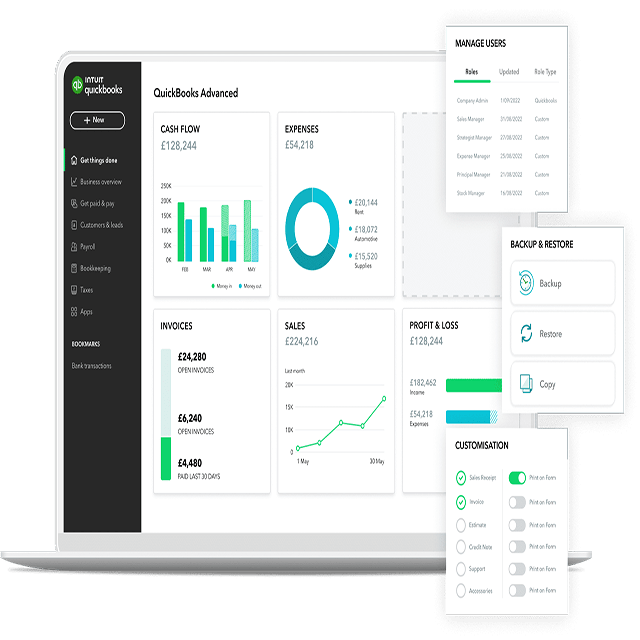

2. Introduction to QuickBooks

- What is QuickBooks and why use it?

- Navigating the QuickBooks interface

- Setting up your company file

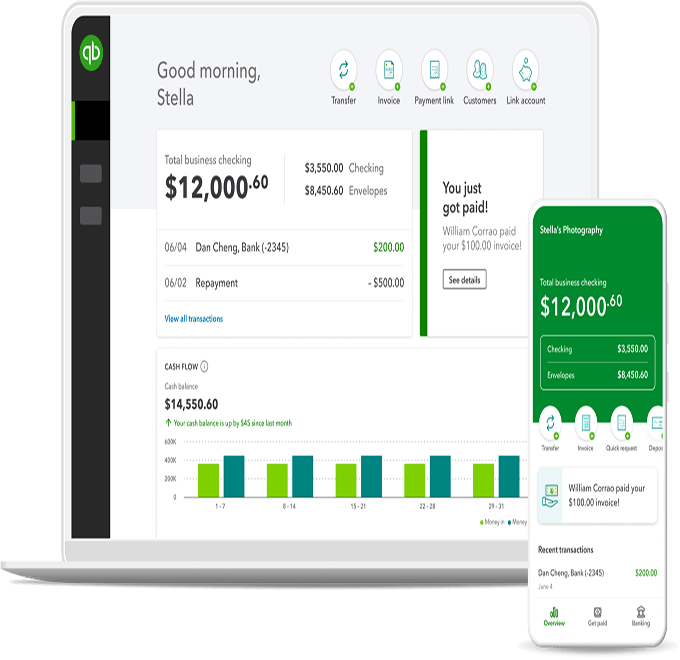

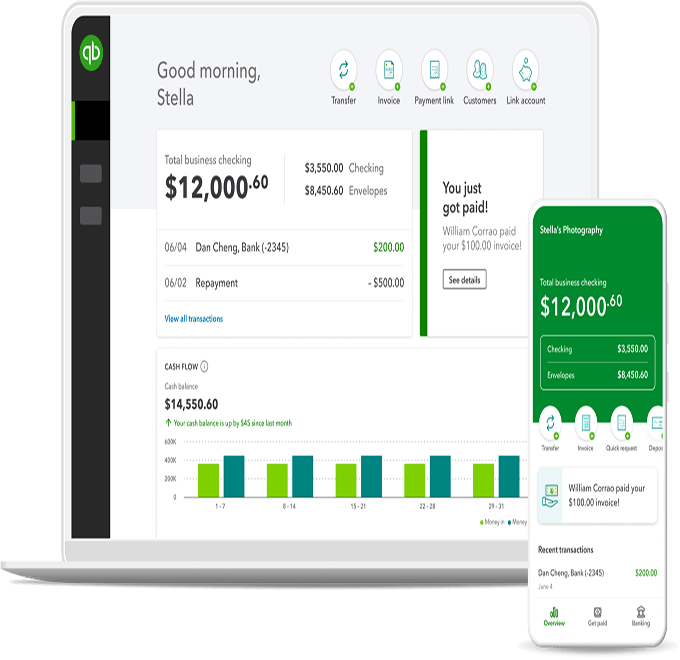

3. Recording Transactions in QuickBooks

- Entering income (sales, invoices, and payments)

- Recording expenses (bills, checks, and expenses)

- Managing bank and credit card transactions

4. Managing Accounts Receivable and Accounts Payable

- Tracking customer payments and managing invoices

- Handling vendor bills and payments

5. Reporting and Analysis

- Generating basic financial reports (Profit and Loss, Balance Sheet, and Cash Flow Statement)

- Analyzing financial data to make informed business decisions

6. Payroll and Taxes

- Setting up and running payroll in QuickBooks

- Managing payroll taxes and filings

7. Tips for Efficiency and Troubleshooting

- Best practices for efficient use of QuickBooks

- Common issues and how to troubleshoot them

8. Final Project: Putting It All Together

- Applying learned concepts to a real-life scenario

- Creating a simple financial report using QuickBooks

9. Conclusion and Next Steps

- Recap of key learnings

- Resources for further learning and support

Sessions

1. Introduction to Accounting

- Understanding the basics of accounting principles.

- Overview of financial statements: Balance Sheet, Income Statement, and Cash Flow.

2. Introduction to QuickBooks

- What is QuickBooks and why use it?

- Navigating the QuickBooks interface

- Setting up your company file

3. Recording Transactions in QuickBooks

- Entering income (sales, invoices, and payments)

- Recording expenses (bills, checks, and expenses)

- Managing bank and credit card transactions

4. Managing Accounts Receivable and Accounts Payable

- Tracking customer payments and managing invoices

- Handling vendor bills and payments

5. Reporting and Analysis

- Generating basic financial reports (Profit and Loss, Balance Sheet, and Cash Flow Statement)

- Analyzing financial data to make informed business decisions

6. Payroll and Taxes

- Setting up and running payroll in QuickBooks

- Managing payroll taxes and filings

7. Tips for Efficiency and Troubleshooting

- Best practices for efficient use of QuickBooks

- Common issues and how to troubleshoot them

8. Final Project: Putting It All Together

- Applying learned concepts to a real-life scenario

- Creating a simple financial report using QuickBooks

9. Conclusion and Next Steps

- Recap of key learnings

- Resources for further learning and support

Course Overview

Embark on a dynamic journey into finance with our “QuickBooks and Accounting Essentials for Beginners” course. Tailored for newcomers, this comprehensive program introduces foundational accounting principles and practical QuickBooks skills essential for modern financial management. From understanding financial statements to seamless transaction recording and payroll management, each module offers hands-on learning opportunities. Dive deep into accounts receivable/payable management and gain insights into generating insightful financial reports for informed decision-making. Through real-life scenarios and troubleshooting tips, solidify your understanding and confidence in navigating QuickBooks efficiently. Join us today to unlock the door to financial proficiency, empowering you to excel in your career or business endeavors with precision and confidence.

Course Overview

Embark on a dynamic journey into finance with our “QuickBooks and Accounting Essentials for Beginners” course. Tailored for newcomers, this comprehensive program introduces foundational accounting principles and practical QuickBooks skills essential for modern financial management. From understanding financial statements to seamless transaction recording and payroll management, each module offers hands-on learning opportunities. Dive deep into accounts receivable/payable management and gain insights into generating insightful financial reports for informed decision-making. Through real-life scenarios and troubleshooting tips, solidify your understanding and confidence in navigating QuickBooks efficiently. Join us today to unlock the door to financial proficiency, empowering you to excel in your career or business endeavors with precision and confidence.

Learning Objectives

Grasp fundamental accounting concepts, including the principles behind financial statements like the Balance Sheet, Income Statement, and Cash Flow Statement.

Navigate the QuickBooks interface with confidence, mastering essential features for efficient financial management.

Learn to record income, expenses, and manage bank and credit card transactions accurately within the QuickBooks platform.

Develop skills to track customer payments, manage invoices, handle vendor bills, and streamline accounts receivable/payable processes.

Harness QuickBooks to generate insightful financial reports, such as Profit and Loss, Balance Sheet, and Cash Flow Statement, and utilize financial data for informed decision-making and business growth strategies.

Learning Objectives

Grasp fundamental accounting concepts, including the principles behind financial statements like the Balance Sheet, Income Statement, and Cash Flow Statement.

Navigate the QuickBooks interface with confidence, mastering essential features for efficient financial management.

Learn to record income, expenses, and manage bank and credit card transactions accurately within the QuickBooks platform.

Develop skills to track customer payments, manage invoices, handle vendor bills, and streamline accounts receivable/payable processes.

Harness QuickBooks to generate insightful financial reports, such as Profit and Loss, Balance Sheet, and Cash Flow Statement, and utilize financial data for informed decision-making and business growth strategies.

Learning Outcomes

Gain a solid grasp of fundamental accounting principles and the ability to interpret financial statements with confidence.

Navigate the QuickBooks interface adeptly, demonstrating proficiency in setting up company files and utilizing key features for efficient financial management.

Develop the skills to record income, expenses, and manage bank and credit card transactions accurately within the QuickBooks platform, ensuring data integrity.

Efficiently manage accounts receivable and accounts payable, including tracking customer payments, handling invoices, and processing vendor bills, optimizing financial processes.

Utilize QuickBooks-generated financial reports to analyze financial data effectively, enabling informed decision-making to drive business growth and success.

Learning Outcomes

Gain a solid grasp of fundamental accounting principles and the ability to interpret financial statements with confidence.

Navigate the QuickBooks interface adeptly, demonstrating proficiency in setting up company files and utilizing key features for efficient financial management.

Develop the skills to record income, expenses, and manage bank and credit card transactions accurately within the QuickBooks platform, ensuring data integrity.

Efficiently manage accounts receivable and accounts payable, including tracking customer payments, handling invoices, and processing vendor bills, optimizing financial processes.

Utilize QuickBooks-generated financial reports to analyze financial data effectively, enabling informed decision-making to drive business growth and success.

Frequently Asked Questions

Edifyed Academy courses do not provide an externally accredited or recognised qualification. Our own expert team works at the course content. With over 40000+ learners, we are continuously growing and our vision is to make Edifyed Academy qualifications renowned worldwide through our expert team, without seeking formal accreditation or recognition from external institutional bodies.

Upon successful enrollment, you will get access to Edifyed Academy Portal (our advanced online learning portal) within 24 hours. (login details and important contact information will be provided on your registered email address)

You will be able to view all course wise live session details including joining links on your Edifyed Academy Portal calendar. Weekly email reminders are also sent out on your registered email address. If you find any difficulty with the link/calendar please contact us immediately via Email: [email protected] or by Phone: +1 (571) 390-4077 . Our dedicated support team will ensure that your problem gets resolved at the earliest.

If you miss a live session, don’t worry! You can access the recorded sessions, presentations, and relevant materials on your course dashboard within 24-48 hours after the live class is delivered. Our admin team uploads the content promptly so you can catch up on what you missed and be well-prepared for the next live class. Simply log in to the Edifyed Academy Portal and find the materials under the respective course section if you miss a scheduled live lecture.

For inquiries about instructor contact information, please reach out to the course administrator directly. Instructor details will be shared only with their explicit consent. However, participants are encouraged to connect through group discussions.

( Please note, they often have demanding schedules and may not always be able to address individual queries. We encourage you to attend live sessions and utilize the Q&A period for questions. For queries post-lecture, feel free to contact our administrators, and we will do our best to assist. Responses from instructors will depend on their availability. Thank you for your understanding.)

The Final Exam will be held at the end of the course(approximately one month after the final live lecture of the course) and will be a Graded And Timed Exam.

The duration of access to paid online courses varies depending on the program length:

- Courses lasting 4/6 months (12/16 sessions): 1 year access

- Courses lasting 9-12 months (24-30 sessions): 2 year access

Please note that these durations apply specifically to our paid courses.

In case you find any trouble accessing your account, then please contact us immediately via Email: [email protected] or by Phone: +1 (571) 390-4077 . Our dedicated support team will ensure that your problem gets resolved at the earliest. The time taken to resolve issues depends on the team’s availability and working hours. We guarantee prompt resolution of your queries. Please be aware that it typically takes around 24 hours to resolve any technical issues.

Following successful course completion, you will be eligible to receive your digital certificate of achievement. To be eligible, you must meet the following criteria:

Completion of All Course Modules: Full engagement with all designated course materials, including readings, assignments, and assessments, is mandatory.

Attainment of the Minimum Passing Threshold: A minimum grade of 40% is required to qualify for the certificate of achievement.

If you have questions or need assistance during your journey, our dedicated support team is here for you. Your success is our priority. Please be patient as our team works round the clock to provide support.

📞 Admissions Team( Payment, Enrollment, or information about New Courses):

- Email: [email protected]

- Phone/WhatsApp: +1 (571) 390-4077 .

🚀 Short-Term Course Support (Assessment, Course-related, or IT-Technical issues):

- Email: [email protected]

- Phone/WhatsApp: +1 (571) 390-4077 .